Lithium-ion batteries are often called the new generation’s gasoline. As the energy efficiency of the cells increases, more applications open up to replace older battery technologies and devices which previously relied on combustion.

If you want to build a device using modern energy storage, there is no alternative to lithium-ion at the moment. So what does this mean for the supply chain?

A new study published by Juele explores this topic titled “Lithium-Ion Battery Supply Chain Considerations: Analysis of Potential Bottlenecks in Critical Metals“.

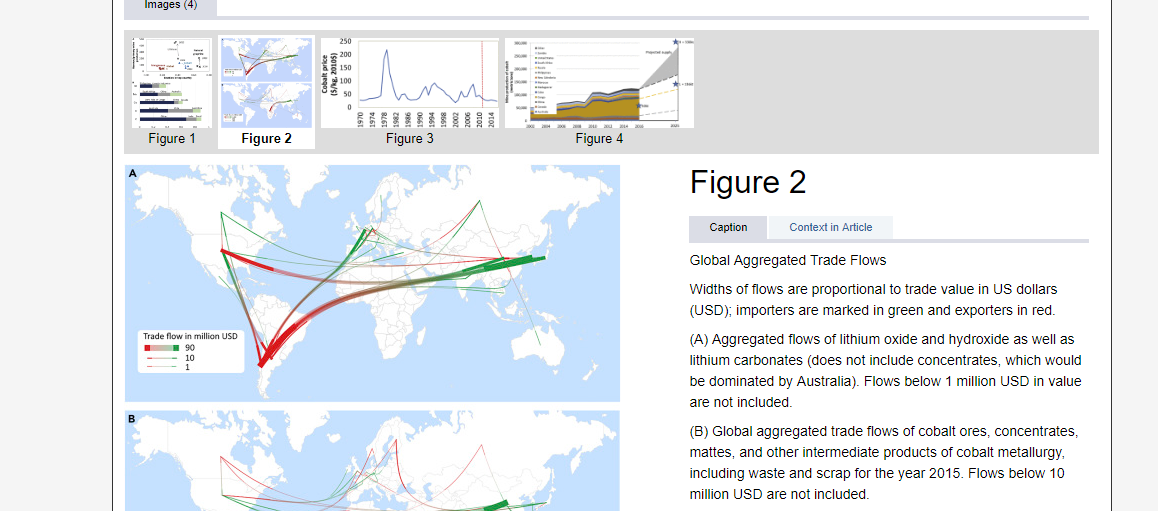

The conclusions of this article state that most metals required in the production of lithium-ion cells will meet demand. However, there are potential risks, particularly with the metal cobalt. Cobalt risk has been speculated for some years now, with the price of this metal increasing substantially as demand outpaces supply.

The problem with cobalt is its origins, with most of the supply centralized in the Democratic Republic of Congo, where there have been many substantiated reports of child labor. The supply side then is easy to see as flaky at best. Geopolitical risks alone cause one to speculate that the price may become volatile in the future. Consider for a moment that 50% of the world cobalt production comes from the DRC, nearly all lithium-ion cells used need cobalt, and a war, sabotage or another incident could cause a supply shortage and increase the commodity’s price substantially. The next war in the DRC may actually be funded by cobalt (hopefully not, but it is a possibility).

Many lithium-ion cells use cobalt as an essential ingredient at the current time, but that doesn’t mean things won’t change. There are other chemical makeups which do not rely as much on cobalt, so it is possible lithium-ion cells will not need this metal in the future, especially if the supply side forces production to circumnavigate this metal. However, this is most likely years away from becoming reality. The problem is cobalt is very energy dense. It has a unique 6 d-electron structure in a low spin state, which leads to a cathode like LiCoO2 with excellent density. Non-cobalt cathodes like the LiFePO4 are used by some industries for an attractive cycle life and stability but still have nowhere near the power or energy capabilities of rival technologies. The article makes an interesting point, that LiFePO4 may become more attractive for certain industries like grid storage if the cost of Ni or Co rises.

Other metals may also become scarce, depending on the rate of adoption–namely by electric vehicles. In the short-term, if electric vehicle adoption speeds up, for example, if China decides to ban gasoline vehicles within the next decade, such short-term demand might exceed the supply side. However, lithium can be found in many sources from brine deposits to more traditional mines, from South America to Australia. Lithium is far more robust to mine than cobalt. And from this, it is rather safe to conclude that even if the demand for Lithium does outpace its supply there will be effective market forces to quickly balance this.

The study finds that Cobalt, Lithium, and possibly natural graphite have the highest supply-side risk associated with them. Other cathode materials like Nickel or Manganese have no detectable risks as their production is well distributed and their use in lithium-ion batteries is a small portion of their overall end-use demand. Likewise, the use of natural graphite in li-ion batteries only accounts for around 2% of global consumption… however this may increase to nearly 10% or higher. It is also noted that synthetic graphite may become a viable replacement.